Duolingo(DUOL): An overvalued business with a broken product

Read https://researchragnarok.substack.com/about for disclaimer on buy-sell posts. This is not investment advice. Do your own due diligence before any decisions. We are not responsible for any losses

Duolingo Inc: An overvaluation unlike no other

Duolingo Inc.(DUOL) is an American education company mostly sepcialised in its language courses. Duolingo’s shares have pumped about 150% YTD, but we think this increase is extremely unwarranted:

1) We have found some weaknesses in Duolingo’s software, which can be detrimental to Duolingo’s revenue if enough users find out about it. Duolingo’s main revenue comes from subscriptions to its premium versions of its language learning app, but we have found vulnerabilities which enable users to access the most valuable perk of the paid version: the Unlimited heart. This showcases a lack of diligence in making a product.

2) We have found potential flaws with Duolingo’s business model and products, and we think that Duolingo’s shares will suffer due to our predicted headwinds on the stock. We also think that Duolingo’s reported metrics such as monthly active users(MAU) might be inflated.

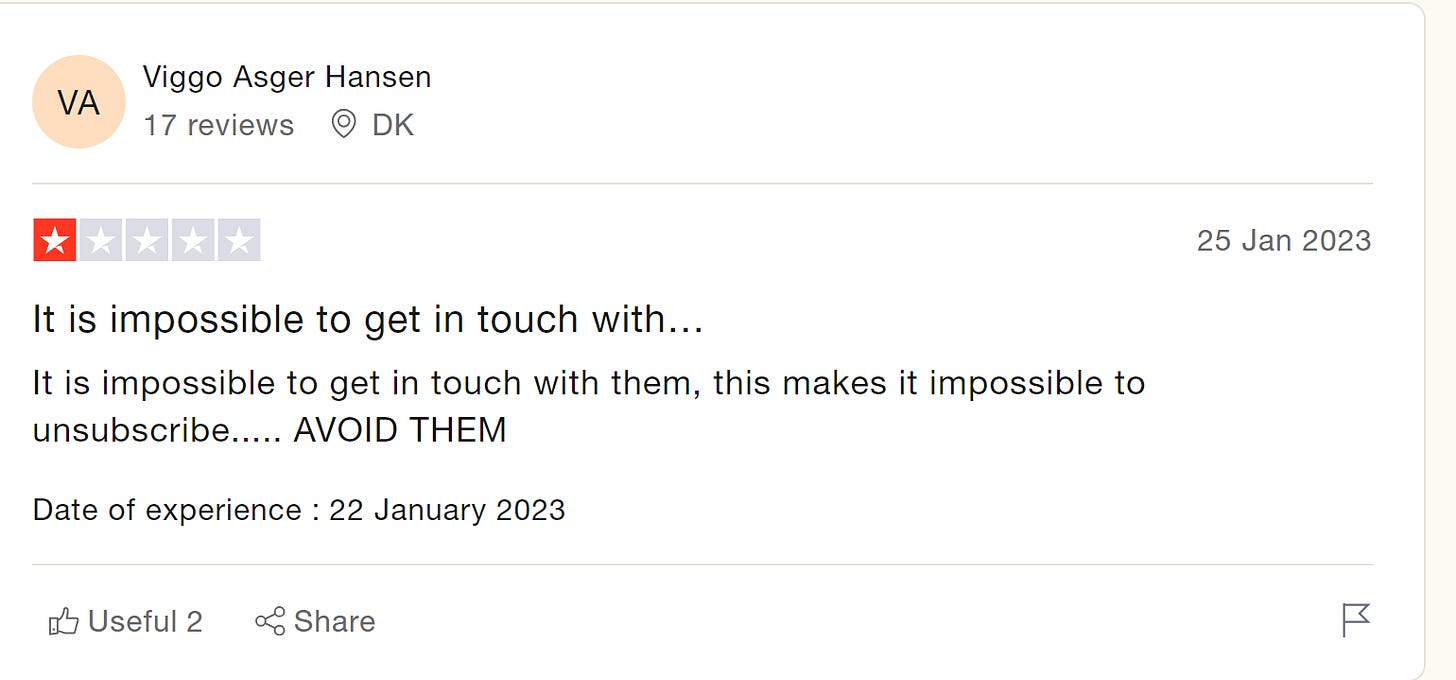

3) We have uncovered both public and anonymous accounts of Duolingo utilising unethical business practices to increase revenue. This includes charging money after a premium account without actually granting the premium account, and in some cases, charging a user the full free after a free trial period ends, without informing them of deduction from their bank account, DESPITE promising to inform the user of this transaction. Duolingo has been known to cease all communications with the user post-transaction.

4) Duolingo’s IPO was backed by Durable Capital Partners LP, but its previous IPO sponsors have had a bad track record:

WRBY stock: -73.25% since IPO

YOU stock: -58% since IPO

Also, Duolingo’s net margins are positive right now mostly due to their interest income, which cannot be sustainable on the long-run according to us.

5) Duolingo has done a lot of promotion using the fact that they have incorporated AI into their Duolingo MAX platform. But, Duolingo MAX costs 30 USD while GPT-4 costs just 20 USD. As time goes on, we think users would switch to GPT-4(given they have released vocal conversations now). We think these LLMs like GPT-4 or Bard will kill Duolingo MAX’s demand.

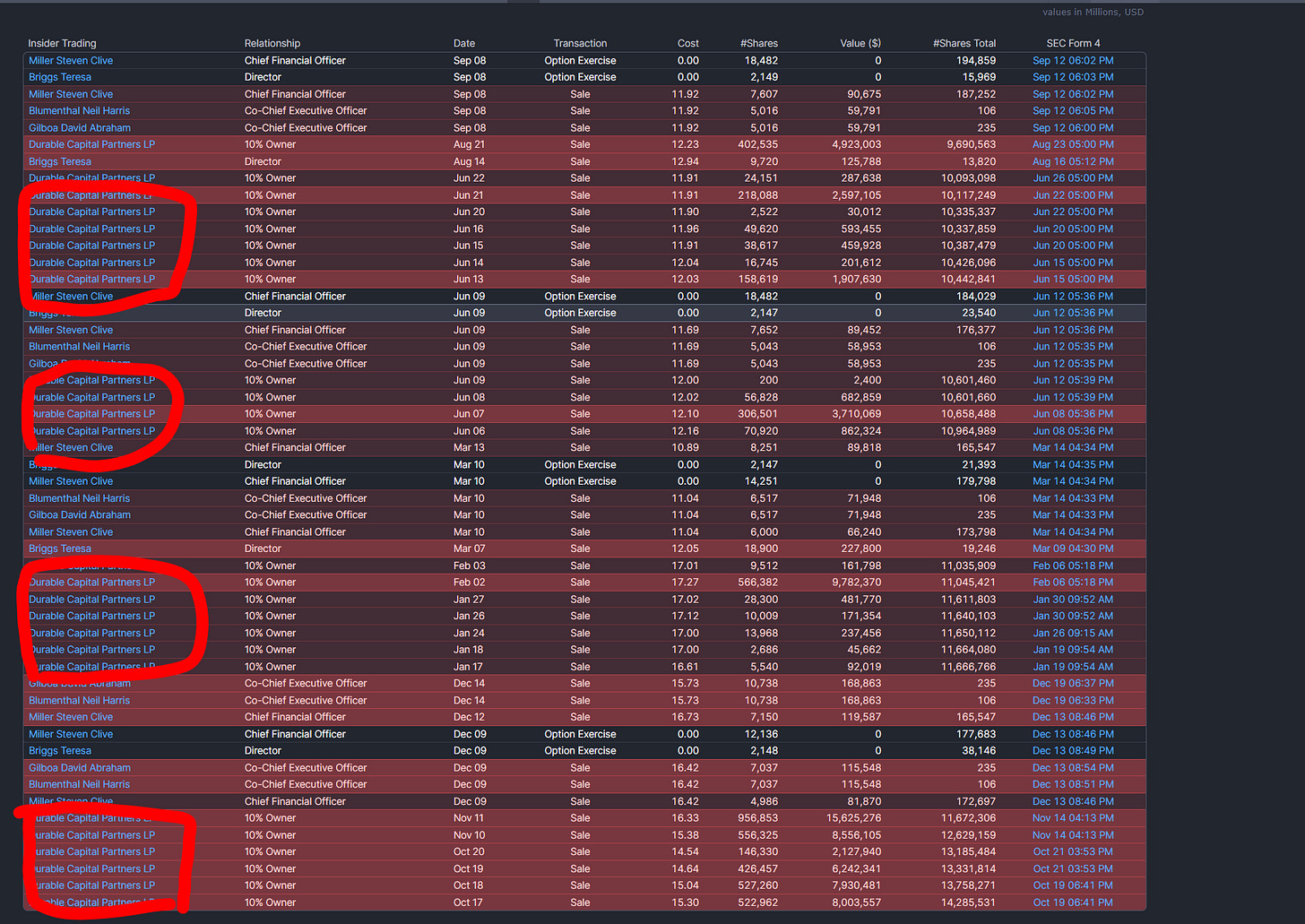

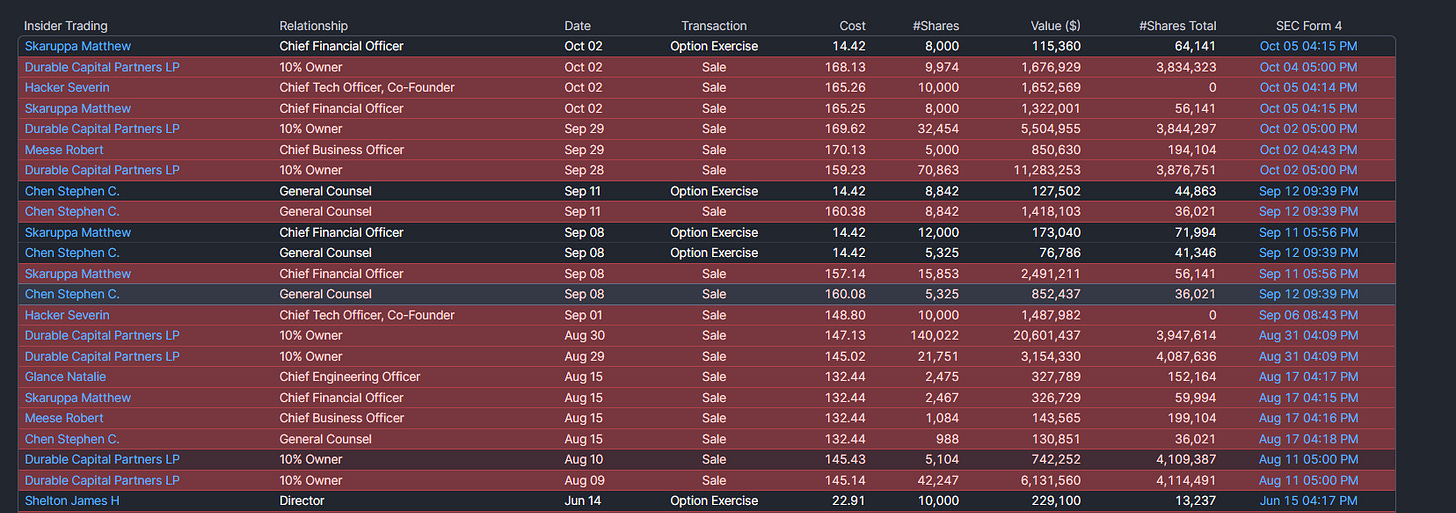

6) Increased Insider sales. Durable Capital have already started to cash out.

Reasons why we think DUOL will suffer:

We have found a weakness in DUOL’s software, which might be evidence of Duolingo’s low-quality products:

According to our research, the primary motivation for users to upgrade from Duolingo’s free version is to be able to earn more than 5 ‘hearts’(where ‘hearts’ are ‘lives’ where a user cannot continue their Duolingo lesson if he/her makes more than five mistakes).

However, there is an unintentional bug to override this restriction, and we think that this is due to DUOL’s lack of seriousness in making the product.

Method: Just registering through a ‘teachers account’ and registering a null class with it:

There is an apparent bug in Duolingo’s system where it is pretty easy to gain unlimited hearts.

It involves swiftly logging in through a ‘Duolingo for schools page, entering a language to learn, and a ‘class name’, which could be anything of a user’s choosing.

After this, the user is automatically granted unlimited hearts, but our research tells us that most Duolingo users don’t know about this ‘hack’ or ‘bug’.

The lack of verification in Duolingo’s systems could be a method for losses of revenues and also a piece of evidence for the lack of quality in Duolingo’s products.

We also have concerns about Duolingo’s safety since it suffered a data breach:Data about users were released publicly in the format:

The API used to scrape and attain this dataset is still vulnerable, according to us, and it can be used by hackers and scammers for social engineering attacks, such as phishing emails, using the plethora of information disclosed by the breach.

Even though Duolingo was alerted of this API vulnerability in January, no corrective action was taken until the actual release of the dataset. After this release, the only precaution was a rate limit, which is not too effective since some data can still be scraped.

This dataset puts the 2.6 million users at risk of phishing attacks and credential stuffing.Duolingo’s potential inflated user metrics:

Duolingo has reported in its most recent Q2 2023 filing that its MAU ‘Monthly Active Users’ were about 74 million.But, according to our research using third-party software(SemRush, etc.), we believe the number has come staggeringly low, and Duolingo will keep experiencing this dip in MAUs(Unique Visitors):

Unethical business practices:

We have spoken to users who have experienced events where they pay for a premium subscription, but they are not granted the perks even after payment. Even after numerous attempts to contact Duolingo, they do not answer and keep the money. Since we cannot disclose these interactions due to anonymity, we shall attach some of many similar experiences noted on TrustPilot:Durable Capital Partners’ failed track record:

Stable Capital has backed a few IPOs, and here are their returns:

Durable’s cluster selling of shares of Warby is a behaviour that we speculate will repeat with Duolingo as well:

The same goes for its other bad IPO, YOU:Unsustainable net margins:

An unhealthy part of Duolingo’s net margins increase is due to its increased interest income:

It has grown from 669,000 USD to 7,543,000 USD YoY. This is a significant contributing factor to the increased net margins. This is due to the high-rate environment. That will eventually end up putting downward pressure on net margins.

Also, we think it can suffer in the long term due to the increased Stock-Based compensation.

A lot of its FCF is being eaten away due to this, and if this continues, coupled with the loss of interest income, it could be troublesome for the stock:The Death of Duolingo MAX:

Duolingo has done a promotional scheme where they have boasted that they are one of the first corporations to incorporate GPT-4 into their platform. But is this really in the best interest of Duolingo? We do not think so.

We have already demonstrated that there are methods to bypass Duolingo’s ‘hearts’ or ‘lives’ restriction. There are a ton of scripts on Git Hub to earn ‘lingots’ or ‘gems’ (Duolingo’s gamified currency). So, the only ‘appeal’ of Duolingo MAX is their AI incorporation, where there is a roleplay and ‘Exloain-my-answer’.

First, we think the main inconsistency of MAX is that the business may not be sustainable. It costs 30 USD per month, while GPT-4, which has voice activation now, only costs 20 USD per month. The partnership with Duolingo has possibly provided a pipeline of language learning data to OpenAI, which will only be used to bolster GPT-4.

In the coming months or years, we think users would much instead switch to GPT-4 for the roleplay feature.

For instance, here is an example on Twitter where a user practices his Russian using GPT-4 as a language learning assistant:https://twitter.com/dmvaldman/status/1707881743892746381

We believe LLMs’ increased prowess can kill Duolingo’s AI assistant demand.

Something similar to Chegg’s 40% stock drop when they announced that ChatGPT is killing its business might happen to Duolingo:Insider Sale of shares:

As previously stated, Durable Cap will keep cashing out, providing some downside pressure on the stock.The overvaluation:

We have compared DUOL to other education companies on a Mkt.-Cap/Revenue basis, and here is what we’ve found:

1) Chegg:

Market cap: 984 Million USD

Revenue(last quarter): 182 Million USD

Ratio: 5.4 (Calculated in millions)

2) Coursera:

Market cap: 2.87 Billion USD (2870 Million USD)

Revenue: 152 Million USD

Ratio: 18.88

3) UDMY:

Market cap: 1.48 Billion USD(1480 Million USD)

Revenue: 178.24 Million USD

Ratio: 8.3

And lastly, Duolingo:

Market Cap: 7.28 Billion USD(7280 Million USD)

Revenue: 126 Million USD

Ratio: 57.7

This shows the sheer overvaluation of Duolingo. The stock price implies revenues that Duolingo will never be able to achieve, owing to competition from LLMs and other factors.

CONCLUSION:

Ragnarok Research believes that Duolingo, sooner or later, will crash down. A 150% increase from January is entirely unwarranted, and we firmly think that this stock will hit. We highlighted the sheer overvaluation in this write-up.

By reading any of our posts, you agree to do your due diligence before making any investment decisions. You agree that the authors of this publication are in no way responsible for your investment decisions and are not liable for any of your possible investment losses. You also agree to acknowledge that we do not guarantee any accuracy in our research. You agree to also not proceed with any legal action against us.

The authors of this publication do not give any buy or sell recommendations and do not ensure any correctness to our claims or findings. Under no circumstances would you hold the authors liable for any investment losses. One should assume that any sentence or statement in our posts can be inaccurate and factually incorrect and should not influence anyone’s investing.

Sincerely,

Ragnarok Research

Interesting company, but the P/S ratio you got is wrong because you used the quarterly sales instead of the annual one. So the valuation of the company is MUCH lower.

Regarding your 1st point, don't you think that Duolingo can quickly fix the bug if a lot of users use it? It doesn't seem to me to be a big problem.