Vita Coco: A Weak and Unethical Supply Chain facilitating violence against the tribal people of Brazil. Public Benefit Corporation ? We don't think so

Read https://researchragnarok.substack.com/about for disclaimer on buy-sell posts. This is not investment advice. Do your own due diligence before any decisions. We are not responsible for any losses

Vita Coco Company: An overvalued business which has undisclosed Supply Chain problems, coupled with loss of distributors and partnerships with unethical companies.

1) The Vita Coco Company(COCO) is an American beverage company which sells coconut water. It has had an impressive stock boost of about 100% YTD, due to increased revenue and market share. But, we at Ragnarok Research think that this will not last due to upcoming problems.

2) Vita Coco announced that they were losing one of their biggest customers, who were responsible for about 20% of their revenues. Still, the stock is up by an impressive margin. But, our real thesis is that Vita Coco might be having some undisclosed supplier problems, as their main supplier of Coconut water is facing serious litigations in Brazil.

3) Vita Coco is a public benefit corporation and claims to do business by ‘harnessing, while protecting, nature’s resources for the betterment of the world’ and ‘creating ethical, sustainable, better-for-you beverages and consumer products that uplift communities and do right by the planet’.

But, we think Vita Coco has a partnership with a company(which is a part of COCO’s supply chain) which engages in criminal activities and fraudulent business activities by endangering tribal lives in Brazil.

4) Expanding upon the point above, we think that it is not unlikely that Vita Coco has sourced coconuts from entities that may have engaged in Child labour. A good chunk of Vita Coco’s coconuts come from Philippine regions where more than half of the coconuts produced have children involved in the exporting process somehow. Is Vita Coco sourcing from here for ‘cheap labour’ ?

5) Vita Coco has the characteristics of a pump-and-dump, where insiders are looking to cash out. Insiders have a shelf offering to sell 26 million shares of Vita Coco. This is about half the shares outstanding of Vita Coco, which is 56 Million shares.

6) Vita Coco insiders are selling their shares and cashing out.

7) Verlinvest Beverages SA, COCO’s largest shareholder, is the same entity behind the Otaly scam, and there is a lot of influence of Verlinvest in Vita Coco’s Board of Directors.

Reasons why we think COCO’s shares will drop in value in the mid-term:

1) Problems with Distributor and Supply Chain:

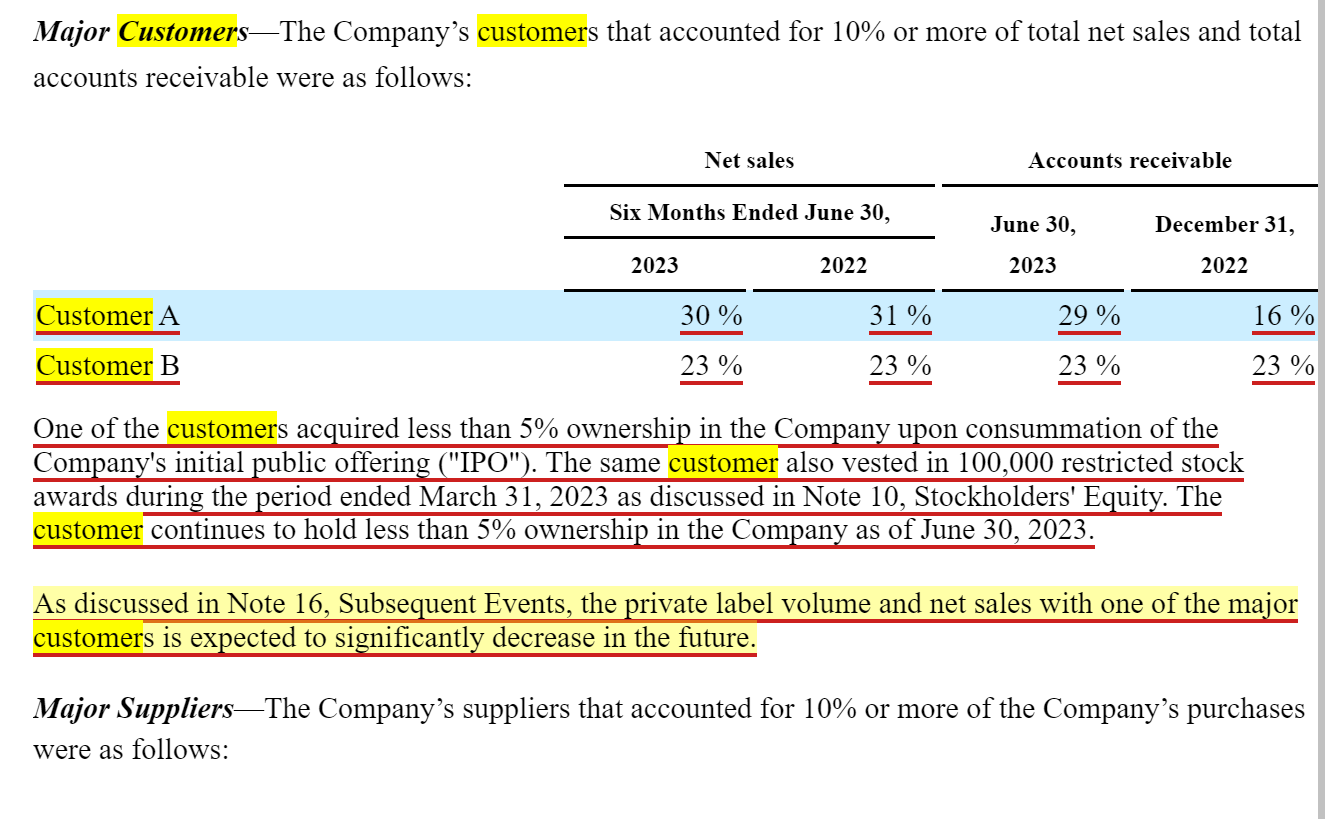

Vita Coco has already disclosed in its most recent quarterly filing that it will be losing one of its biggest customers, which accounted for about 15-20% of their revenues:

This should already have investors worried about Vita Coco’s future outlook.

But there’s more!

Vita Coco heavily depends on its supply chain, which puts it at considerable risk:

They even mention it as a risk factor that any disruptions to their nimble Supply chain could be problematic:

According to ImportGenius(As given above), one of Vita Coco’s top suppliers is an entity in Brazil called ‘Ducoco’, which owns coconut farms and exports coconut water to Vita Coco. As seen in the figure above, Vita Coco depends heavily on Ducoco.

We have recently come across some evidence that Ducoco might present a weak link in Vita Coco’s supply chain due to the amount of litigation it faces.

According to Brazilian media outlets and sources such as News, it turns out that Ducoco has engaged in land grabbing and notary fraud by stealing land from the Tremembé de Almofala Indigenous Land (TI) in the municipality of Itarema.

According to a report ‘Os Invasores: quem são os empresários brasileiros e estrangeiros com mais sobreposições em terras indígenas’ by a rural journalist group in Brazil, one of the properties, Fazenda São Gabriel, has 76.7% of its extension overlapping the IT. The second property, known as Fazenda Aguapé, also has 274.83 hectares within the Tremembé territory. Although the process of demarcation of the Tremembé de Almofala TI began in 1986, the history of the Tremembé territory is centuries old, having been where indigenous people have lived since 1857. The historical relationship between indigenous people and the territory began to be completely disrespected after the company Ducoco, whose headquarters were located in São Paulo.:

We think this is unethical in Vita Coco’s supply chain.

But, the land might be taken away by Ducoco and given to the indigenous people of Tremembé territory.

The demarcation process has already begun, and Ducoco recently appealed to the court for the nullity of this demarcation.

In February 2023, Ducoco requested the nullity of the demarcation process for the TI Tremembé de Almofala. The request was denied by Judge Marcelo Sampaio, of the 27th Federal Court of Itapipoca (CE).

In his decision, the judge found inconsistencies in the company's version, pointing to a possible sign of land grabbing or notary fraud:

This is related to Ducoco. But, due to very recent developments, all companies using tribal land for corporate uses will suffer a loss of assets, since the Supreme Court gave the following ruling:

This, according to us, puts even more pressure on Ducoco since this demarcation operation will be carried out throughout Brazil:

Although there have been efforts to curb the court’s decision by the Senate, Brazilian President Lula is expected to side with the Indigenous People.

We feel that this crucial link in Vita Coco’s supply chain can snap at any moment, considering that the very existence of Ducoco is in question:

We think it’s absurd that Vita Coco would have any ties with such a corrupt and disastrous company.

All in all, this could spell trouble for Vita Coco. We also question Vita Coco’s decision to stick such a disgrace to a company. Ducoco has been accused of violence and destroying the tribal people’s homes. This is a conflict of interest of Vita Coco, considering it is a Public Benefit Corporation.

2) Child labour involved in Vita Coco’s supply chain ?

While the above points detailed our investigation of Brazil, we will now comment on what we think of Vita Coco’s supply chain in the Philippines.

A large part of coconuts from the Phillippines come from a region called Mindanao. We have evidence from the US Department of Labour that shows that there is a lot of child labour schemes in Mindanao:

The DOL also published specifically about coconut supply chains relating to Child Labour.

Even though this data is not exactly conclusive, we shall leave it here merely as a data point which may or may not matter in the future.

3) Is this all a conflict of interest since Vita Coco is a Public Benefit Corporation?

Vita Coco has done a lot of promotion, citing its loyalty to agriculture and the environment. But do these recent claims even hold any value?

We are attaching the following letter to management:

Dear Vita Coco Management,

I am writing to express my grave concern and disappointment regarding Vita Coco's recent business dealings with a Brazilian company, Ducoco, accused of engaging in corrupt practices and causing severe harm to tribal communities in Brazil.

Ducoco has been involved in the Brazilian Marco Temporal Thesis, where corporations have chased indigenous people away from their homes to farm coconuts/soybeans, etc.

Ducoco is also related to various other frauds and corruptions highlighted by Operation Lava Jato.

Vita Coco is a Public Benefit Corporation, promising to protect natural resources, build thriving communities, and champion health and wellness.

You claim to help farmers in countries in your Supply Chain.

Then how is it possible that Vita Coco can have any ties with a company with values and mottos conflicting with yours?

We feel the need to hear a response from your management about this. Please issue a response regarding your involvement with Ducoco, especially since this involvement negates every claim and promotional stunt you have done so far about your ‘ESG Impact’

Regards,

Ragnarok Research

4) Characteristics of a Pump-and-Dump?

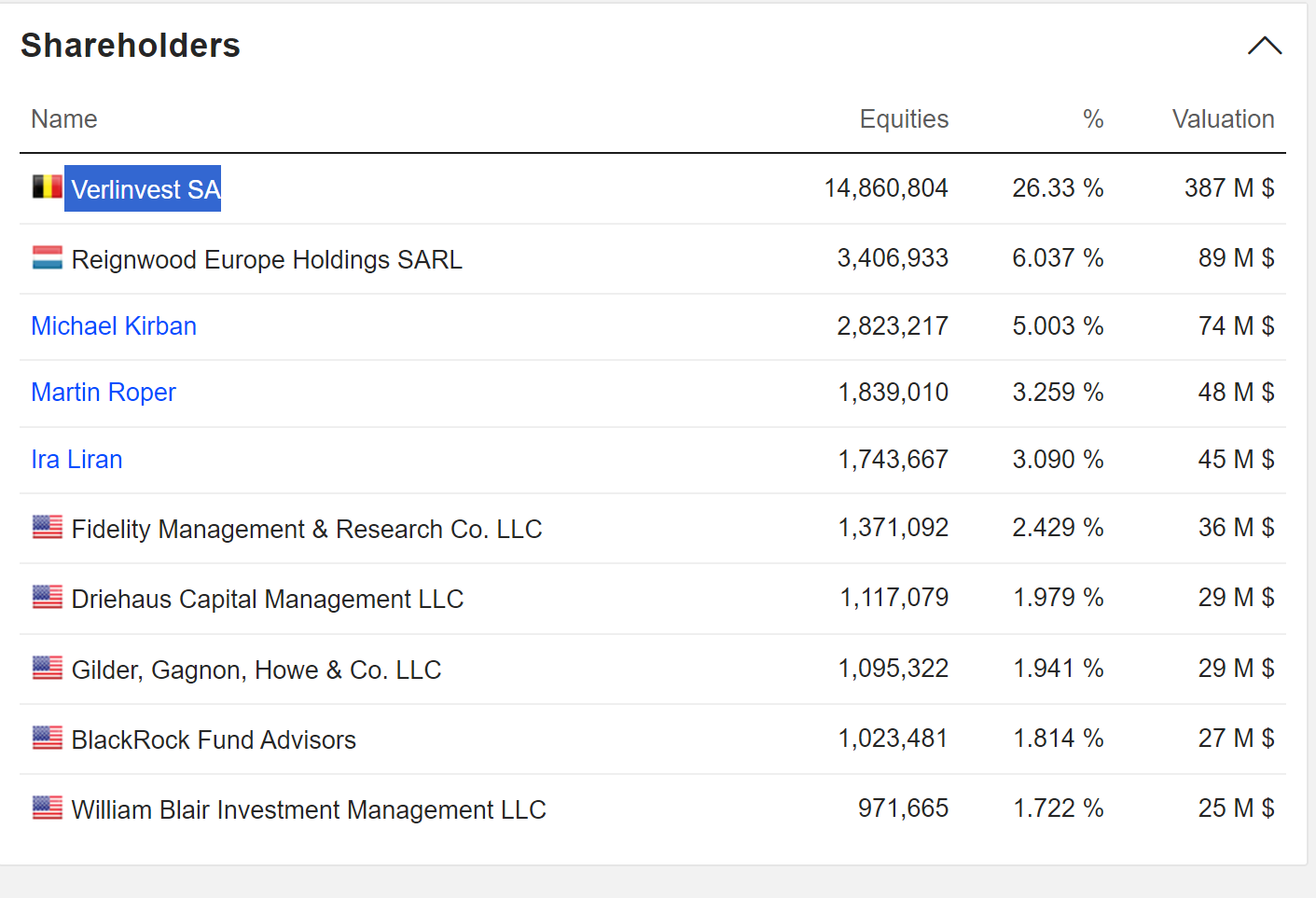

Vita Coco has about 56 Million shares outstanding, but Insiders have a shelf offering of about 26 Million. Most of these is by Verlinvest Beverages. Coco’s stock is still up because Insiders owns a large number of shares.

We strongly believe that Verlinvest will sell its shares, and COCO will lose most of its value:

There is a strong intention to cash out, according to us.

5) The Cashing out has already begun:

6) Supplier and Distributor problems are already manifesting:

7) The track record of Verlinvest Beverages:

Verlinvest Beverages own a huge stake in Vita Coco:

But, Verlinvest Beverages is also affiliated with another company:

Oatly is the only other publicly traded Beverage stock that Verlinvest has backed, and it turned out to be a massive scam.

First off, let us re-iterate that out of COCO’s 9 Board members, 4 of them are related to Verlinvest:

Aishetu Fatima Dozie: Elected by Verlinvest

Eric Melloul: Managing director of Verlinvest and Co-chairman of the Board at Oatly

John Leahy: Elected by Verlinvest

Kenneth Sadowsky: Advisor at Verlinvest

The influence of Verlinvest in Vita Coco is evident.

Oatly, heavily influenced by Verlinvest, it was so outrageous that they made a website detailing their own scams, PR failures, lawsuits, and more. They called it ‘Fck Oatly’

A small sample of the site:

Conclusion:

Ragnarok Research believes that Vita Coco, sooner or later, will crash down. A 100% increase from January is completely unwarranted, and we firmly think that this stock will crash. It currently boasts of a PE ratio of 54, while other Non-Alcoholic brands, such as Monster(PE: 35) , Dr. Pepper(PE: 24) are relatively unervalued.

By reading any of our posts, you agree to do your own due diligence before making any investment decisions. You agree that the authors of this publication are in no way responsible for your investment decisions, and are not liable for any of your possible investment losses, and you also agree to acknowledge that we are do not guarantee any accuracy in our research. You agree to also not proceed with any legal action against us.

The authors of this publication do not give any buy or sell recommendations and do not ensure any correctness to our claims or findings. Under no circumstances would you hold the authors liable for any investment losses. One should assume that any sentence or statement in our posts can be inaccurate and factually incorrect and should not influence anyone’s investing.

Sincerely,

Ragnarok Research